ABI October 2020: As the decline in billings continues to slow, architecture firms report an increase in contracts signed for new work

60% of firms have seen higher prices/more limited availability of construction materials in the last six to 12 months

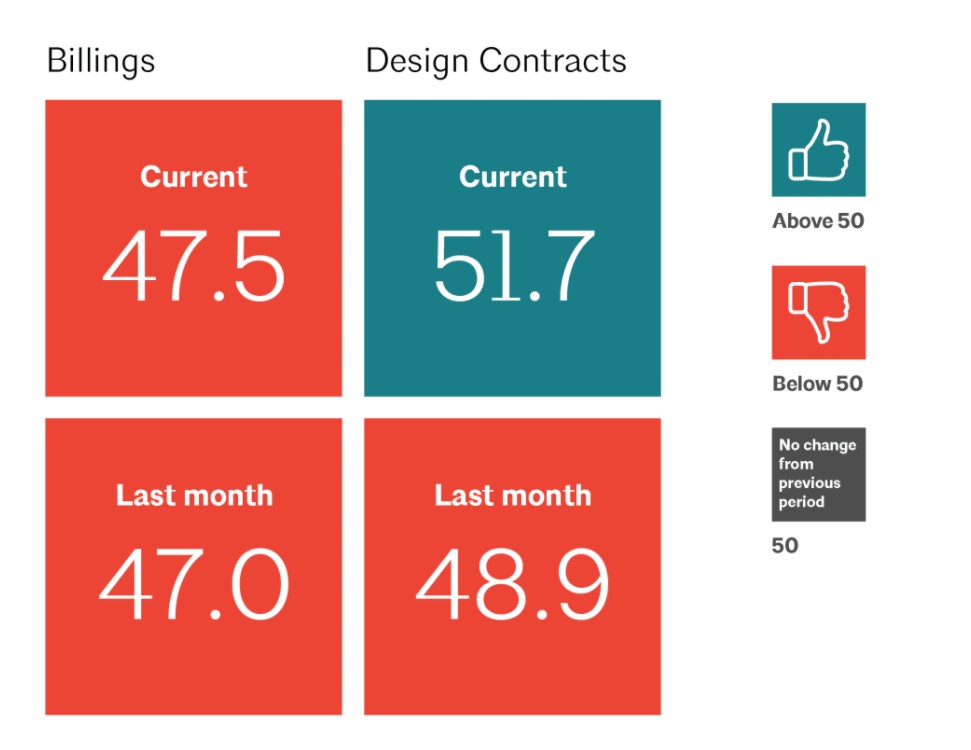

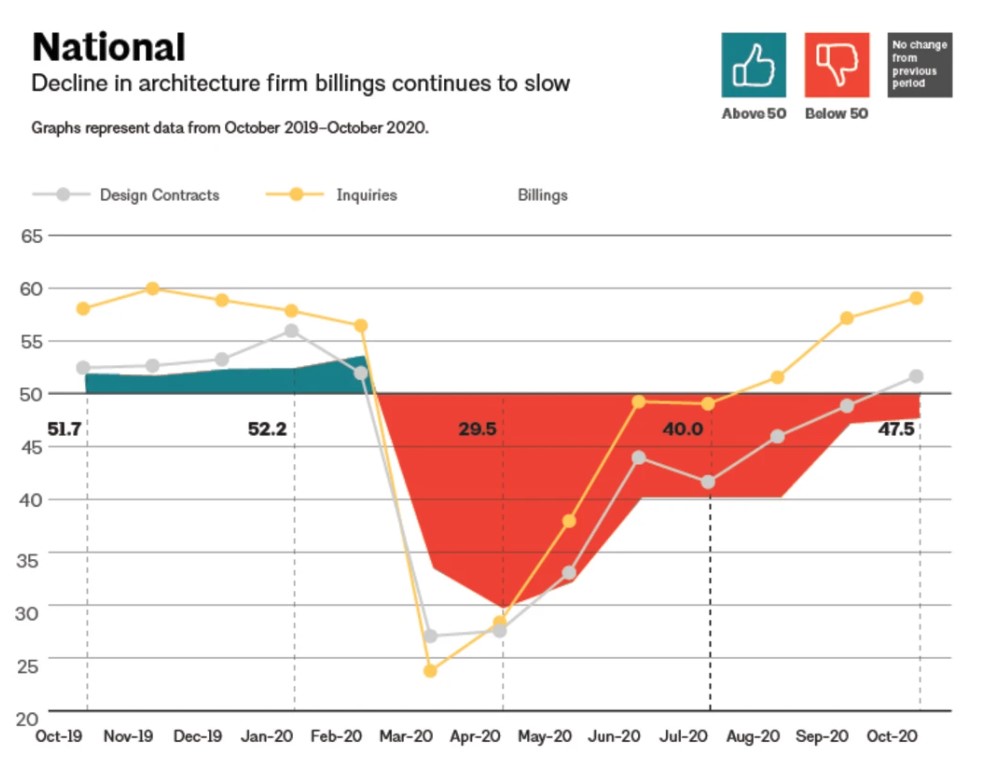

Business conditions at architecture firms moved slowly towards recovery in October, as the pace of the decline in firm billings continued to slow. The ABI score rose slightly from September to a score of 47.5 in October, indicating that the share of firms seeing their billings decline shrank further (an ABI score below 50 indicates a billings decline). In addition, indicators of future work strengthened, with inquiries into new projects climbing to their highest level in nearly a year, and the value of new design contracts growing for the first time since February. This means that not only are clients talking to firms about potential projects; they’re signing on the dotted line to start those projects. Both of these indicators are encouraging signs that business is slowly, but steadily, returning at many firms.

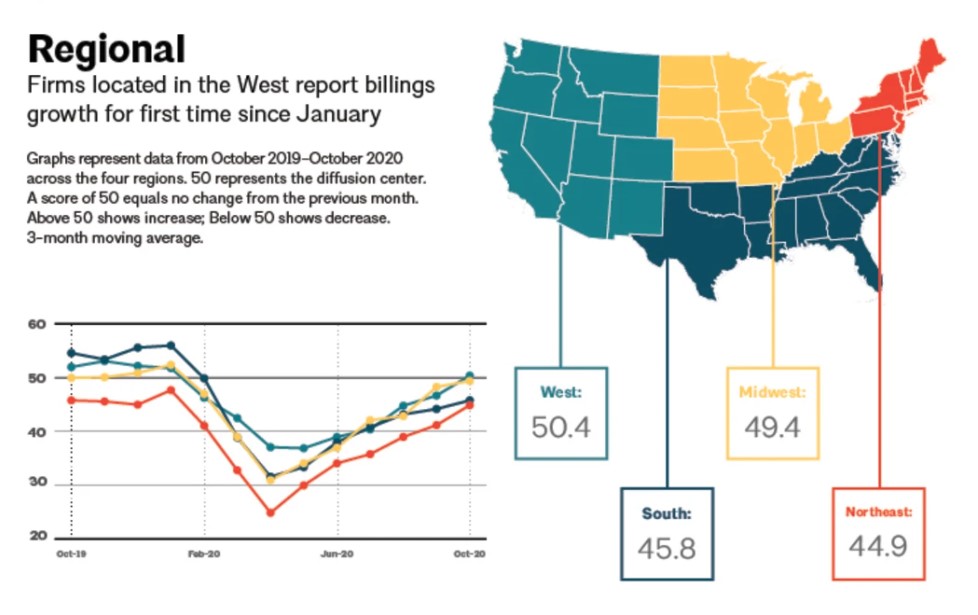

Despite encouraging numbers overall, firms in many areas of the country are still seeing relatively weak business conditions. However, billings returned to the positive side at firms located in the West for the first time in nine months in October, and conditions approached growth at firms located in the Midwest. By firm specialization, business conditions continued to strengthen at firms with a multifamily residential specialization, reaching their highest level in more than two years. In addition, the pace of the decline in billings has slowed substantially at firms with a commercial/industrial specialization; now firms with an institutional specialization are experiencing the softest conditions.

Trends toward growth

In the broader economy, there have also been encouraging signs recently. Total nonfarm payroll employment rose by 638,000 new jobs in October, with construction employment contributing 84,000 positions. Architectural services employment added 2,500 new positions in September (the most recent data available), which, combined an increase of 3,100 positions in August, nearly offsets the loss of 5,900 positions in July. And in the third quarter of 2020, the real Gross Domestic Product (GDP) grew sharply at an annual rate of 33.1%, following an equally steep decline of 31.4% in the second quarter. Gains in the third quarter were largely led by an increase in personal consumption expenditures, notably in goods (cars, clothing) and services (healthcare, food services, accommodations).

Availability of materials is impacting firms

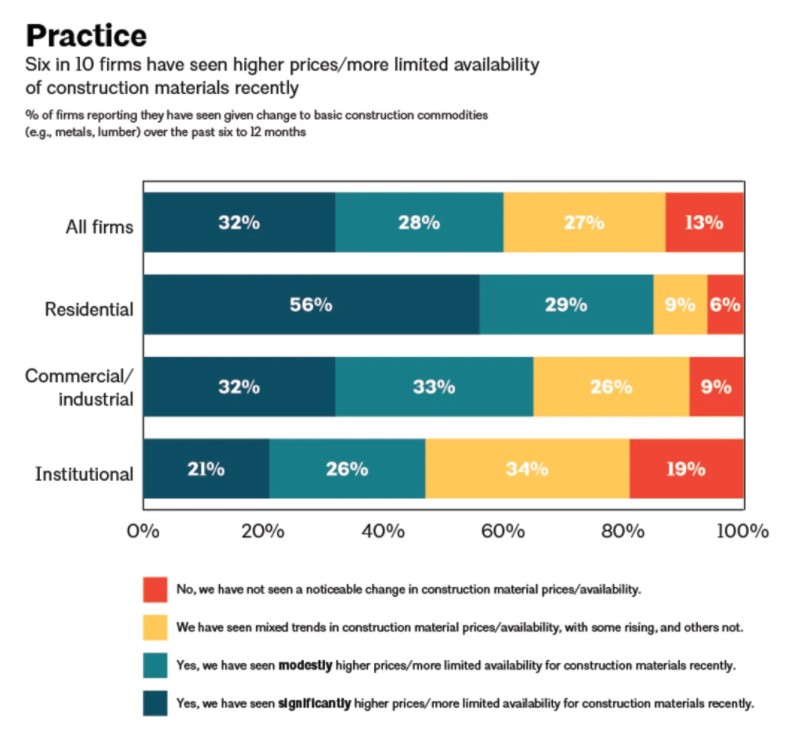

Recently, there have been reports of rising prices and/or more limited availability of construction materials and products in many parts of the country. This month’s special practice questions asked firms about whether they’ve seen any changes in the prices/availability of construction materials, and if so, what impact that has had on projects at their firm.

Overall, six in 10 responding firms this month indicated that they have seen some degree of higher prices/more limited availability of construction materials over the past six to 12 months, with 32% reporting significantly higher prices/limited availability, and 28% reporting modestly higher prices/limited availability. An additional 27% reported that they have seen mixed trends, with some rising and others not, while just 13% said that they have not seen any noticeable change in construction material prices/availability. Firms with a multifamily residential specialization were by far the most likely to report having seen higher prices (86%), in contrast to 65% of firms with a commercial/industrial specialization and 48% of firms with an institutional specialization.

At firms that reported that they have seen higher prices/more limited availability for construction materials in the past six to 12 months, 91% indicated that price/availability issues are at least a somewhat serious problem at their firm, with 15% reporting it as a very serious problem. Just 2% of firms indicated that it was not a serious problem. Firms with a multifamily residential specialization were once again more likely to report an impact, with 95% of those firms indicating that this was at least a somewhat serious problem, in contrast to 92% of firms with an institutional specialization and 87% of firms with a commercial/industrial specialization.

Firms were also asked about what actions they, or their clients, have taken in response to rising construction materials costs/more limited availability, and just under half indicated that they have scaled back scope or size of projects and/or increased project construction budgets (44% of firms selected each response). In addition, 43% indicated that they have substituted less costly construction materials, 36% have put projects on hold or dropped projects entirely due to higher costs, and 32% have redesigned projects to accommodate higher costs. Just 14% indicated that they have not taken any response yet, as their current budgets are generally adequate even with higher materials costs.

This month, Work-on-the-Boards participants are saying:

- “Senior housing is busy across the country. Difficult to keep up with the projects, especially with the materials changes.”—43-person firm in the South, residential specialization

- “Business conditions are a bit better than in the summer. While all major work is on hold, smaller projects appear to be moving forward, albeit slowly.”—20-person firm in the Northeast, institutional specialization

- “Projections for the next couple months are close to normal levels, but after year-end they drop off a cliff.”—155-person firm in the West, commercial/industrial specialization

- “We are seeing increased competition for fewer projects by firms seeking additional market sectors and increasing their geographic range. Architects in our area are pursuing any and all projects to maintain billings and retain qualified staff.”—35-person firm in the Midwest, institutional specialization